In-State Tuition and Financial Aid for Expats

Financial aid tips for American expats applying to US colleges

Can expat students get in-state tuition and other financial aid?

Unfortunately, expats are generally not eligible for in-state tuition as this is tied to where the student and their parents have resided in the time leading up to the college application. While you may have spent time living in the US before, you are not eligible for in-state tuition in most states unless you have lived in that state for at least 12 months before applying to college. Also, living in the state later does not change your eligibility after starting college.

If you are living abroad due to a parent’s military service, it may be possible to get in-state tuition if they are only abroad for their service and still have domicile in that particular state. This is very dependent on the state and situation, so it is best to discuss it with the colleges you are considering beforehand.

Financial Aid for Expat Students

The good news is, unlike international students, American expats are eligible for federal financial aid and much more institutional aid at colleges in the US. Pay attention to financial aid and scholarship deadlines announced by each college of interest and follow all instructions to apply.

In order to apply for federal aid, you must complete the FAFSA (Free Application for Federal Student Aid) each year. This is the application you would use to qualify for potential Pell Grants, Subsidized and Unsubsidized student loans, Direct PLUS loans and Work Study. This application is usually submitted starting in October of the student’s senior year. All US citizens (and some non-citizens) are eligible to apply for federal aid regardless of where they reside. Pay attention to documents required to complete the form and note that all entries must be converted to U.S. Dollars using the exchange rate published by the Federal Reserve.

Some schools (many private colleges) also require the CSS Profile to determine institutional aid awards which are given by the school directly and do not need to be repaid. All students, regardless of citizenship, may be required to complete this form to be eligible for institutional aid. This form automatically converts entries into USD, so you are able to enter the amounts in your local currency if needed.

Familiarize yourself with both the CSS Profile and FAFSA and gather the documents needed to complete them early. Check the instructions to apply for financial aid, both need and merit based, at each of your colleges before you even submit your application for admission. Deadlines for some scholarships may be very early and you don’t want to miss out!

Check out our other blog posts in our American expat series for more tips!

How to Apply for Florida Bright Futures

What is Bright Futures? How do you become eligible for the scholarship? If you are planning on or even considering attending college in Florida, you need to know this information and the earlier, the better.

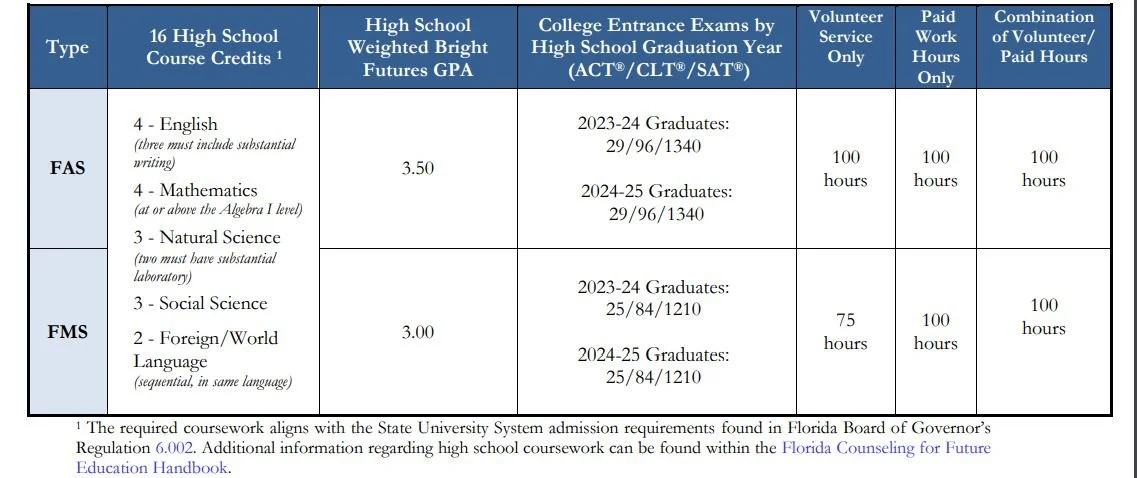

What is Bright Futures? How do you become eligible for the scholarship? If you are planning on or even considering attending college in Florida, you need to know this information and the earlier, the better. While there are 4 types of scholarships which are part of Florida Bright Futures Program, this information is focused on the 2 primary scholarships for students who plan on pursuing an undergraduate degree or certification at a college or university in Florida – the Florida Academic Scholars (FAS) and the Florida Medallion Scholars (FMS).

To be eligible for Bright Futures, students must:

Be a Florida resident and US citizen or eligible non citizen

Graduate from a Florida public high school or a registered Department of Education Private institution, earn a GED or complete an eligible Home Education program

Meet high school college prep coursework requirements

Be accepted to and enrolled at a Public or eligible private post-secondary institution in Florida

Not have been convicted of or plead no contest to felony charges

Meet official standardized test score and GPA requirements

Complete 100 hours of volunteer service and/or paid work

Have official transcripts sent from high school

Complete the Florida Financial Aid Application (FFAA) by Aug. 31 after senior year

Image from Bright Futures Handbook

The FAS scholarship is the highest level available to students and covers 100% of tuition and applicable fees at Florida public institutions. If a student chooses to attend an eligible private institution, they are given a comparable amount which could add up to approx. $6000.

The FMS scholarship is the second tier and covers 75% of tuition and applicable fees or 100% of an associates degree. It also covers a comparable amount at eligible private institutions.

To apply for Bright Futures, students must first complete the Florida Financial Aid Application (FFAA). This application typically opens on October 1 and must be completed by August 31 post graduation. After applying for the FFAA, the student will gain access to complete the Bright Futures application.

Students can send their test scores by simply requesting an official test score to be sent to any of the 12 Florida sate universities, state colleges or public high schools. Students have until August 31 post graduation to meet the testing requirements, which means completing testing by June 30. Scores can be superscored and students can take it as many times as needed to get the minimum required scores. Students can bypass the test score requirements if they complete an AICE or IB Diploma.

Service and work hours must be completed by high school graduation. To verify what activities meet the service hour requirements, students should speak to their high school counselors. Whatever the activity may be, the student must get the signed verification from the appropriate supervisor. Activities which typically count towards the service hours are volunteering for nonprofits, working on local political campaigns, or interning at local businesses. As of June 2022, paid work now counts towards the 100 hour requirement.

Students can complete their application any time after December, when they are able to officially enroll at one of the eligible post-secondary institutions. The funds will be distributed directly to the college. Students should ensure they keep their account updated with the institution they are attending as well as their service hours. They should also make sure their counselor sends their official transcripts.

Both levels of Bright Futures can be used for summer semester and depending on the college's programs, may be able to be used for study abroad. A common misconception is that the Bright Futures is a 'full ride'. However, it covers solely the tuition and some fees. unless a family has a 529. Families should not neglect to seek additional funding such as scholarships and other institutional and federal financial aid. Parents should follow all deadlines to file the FAFSA and CSS PROFILE where required in order to be eligible for other aid.

When families have a 529 Plan, the schools apply those funds first and then the Bright Futures. In this case, Bright Futures funds can be used for expenses other than standard tuition and fees. If there are funds left over, the school will usually give them back to the student to use for additional expenses.

Consider the requirements early as you go through high school and begin to complete the service hours, meet college prep course requirements, and prepare for standardized tests to ensure you do not miss out on these extra funds! Schedule a free consultation with us to discuss Bright Futures and your college search and applications.

How to Apply for Financial Aid in the US as an International Student

Studying in the United States is a dream for many international students seeking quality education and diverse experiences. However, the cost of attending a U.S. university can be a significant barrier for students no matter where they are from. In this blog post, we'll explore the process of applying for financial aid as an international student at U.S. universities.

Studying in the United States is a dream for many international students seeking quality education and diverse experiences. However, the cost of attending a U.S. university can be a significant barrier for students no matter where they are from. In this blog post, we'll explore the process of applying for financial aid as an international student at U.S. universities.

Understanding Financial Aid Options

Before diving into the application process, it's important to understand the types of financial aid available for international students:

1. Institutional Aid: Aid which comes from the university itself, more common with private universities

Merit-Based Scholarships: These scholarships are awarded based on academic, athletic, artistic, or other achievements. They may cover part or all of tuition costs. Often, they do not require a separate application and are awarded based on the student’s general application for admission. These are VERY competitive and not offered by some top universities such as the Ivy League institutions.

Need-Based Aid: While international students are not eligible for federal financial aid in the US, many universities offer need-based aid to international students. This aid can come in the form of scholarships and grants which do not have to be repaid. This aid requires some form of application including details on the family’s income and financial resources.

2. External Scholarships and Grants: There are numerous external organizations, foundations, and governments that offer scholarships and grants to international students studying in the U.S. These can be based on academic merit, field of study, country of origin, or other criteria.

Applying for Financial Aid

The application and policy for institutional aid varies significantly by university. Some universities do not offer need-based aid to international students at all, others such as Columbia or UChicago meet 100% of demonstrated need, and some colleges may offer both need and merit aid. It is important to thoroughly research the policies and requirements for each college before making the decision to apply there.

Colleges which offer need-based aid to international students will require the submission of either the CSS Profile, International Student Financial Aid Application (ISFAA) or their own version of a financial aid application. This financial aid form is due with or shortly after the application for admission. These forms require information about the family income, assets and expenses. You will usually be required to upload proof such as tax returns and income statements translated to English in order to complete the applications. Begin working on these applications early enough to gather the required documents well ahead of the stated deadlines.

It is common policy that if a student does not apply for financial aid for their first year, they are ineligible for need-based aid for the following years. So if your family truly needs aid, make sure you complete all forms accurately and ON TIME before the student’s first year of college.

Important Questions to Consider

1. Will applying for aid affect your chances of admission?

2. Are there other colleges which would give you more aid?

3. Are there other colleges which are great fits and cost less overall?

4. Can students get a job and and/or manage a job while attending college?

While the cost of studying in the U.S. can be daunting for international students, there are various financial aid options available to help make education more accessible. By researching opportunities, preparing strong applications, and staying persistent, you can increase your chances of receiving the financial support you need. This is an important issue I help my students and their families navigate as we work together on their college search and applications. If you have questions about applying to US colleges as an international student, schedule a free intro meeting with me.

Budgeting in College

While keeping track of finances before college may not have been of concern to some students, it is a vital skill to learn for all. Parents should take the time to sit with their student and discuss budgeting before they arrive on campus for freshman year. It is important for families to establish a plan for how pay for both expected and unexpected expenses.

While keeping track of finances before college may not have been of concern to some students, it is a vital skill to learn for all. Parents should take the time to sit with their student and discuss budgeting before they arrive on campus for freshman year. It is important for families to establish a plan for how pay for expenses both expected and unexpected.

After the first major decision of how the direct expenses (expenses paid directly to the school) of tuition and fees and room and board will be paid for, families have to take into consideration the indirect expenses which will most likely be incurred. These usually include transportation, books and supplies, and personal expenses such as health insurance. Creating a list of these expenses and calculating what is expected to be needed monthly will help families understand what funds are necessary before the bills come in. A plan should be in place for paying for these expenses before the student sets off for college.

In addition to the expected expenses, it is a good idea to budget for the unexpected such as additional trips or activities the student may want to do and other discretionary spending. Where will these funds come from? Make a plan!

Many students already have their own checking account from saving and working while in high school, but if they do not, it is time to set one up together. Most major banks offer free checking accounts to students, but it is worth considering banks local to the college first in case an issue arises. Parents can easily send money to the account as needed and get access to the account summary (if student agrees of course). Check out this Forbe’s ranking of student checking accounts and what to consider when choosing where to open your account.

There are some very helpful programs to assist with keeping track of budget and spending and it is great practice for life in the 'real world'. Mint is a free program which allows you to set a budget for different categories, keep track of all expenses and bills, and make sure you make your payments on time. At any time, you can log in to see where you stand for the month and get a good look at how well you are staying on budget. They also have a mobile app which is perfect for today's students who never go anywhere without their phone.

Should students get a credit card? College is a great time for students to get their first credit card not only to have in case of emergency, but also to begin building their own credit history. They can also begin to acquire points for spending. As long as the student fully understands what the card should be used for, payments are made on time and you choose one with low or no fees, it can be a great thing to have. Take a look at NerdWallet's May list of Best College Student Credit Cards to get an idea of the associated details to consider.

Keep in mind as you are budgeting for future years that you need to fill out the FAFSA each year to continue to receive financial aid and you can continuously apply for outside scholarships throughout all college years. If you have any major changes in your financial situation which would increase your need, be sure to communicate that with the financial aid office as soon as possible.

These are all things you can begin working on this summer while your student is still at home. Make a plan, talk about it, and continue to communicate the importance of budgeting and discussing expenses even after they are on campus. It is a lifelong skill we all need and an important part of your student's journey to adulthood.

December and January Scholarships

Check out my short list of scholarships with December and January deadlines as well as recommendations for finding more.

Between completing college applications and finishing out the year with lots of school work, most students have not had time to apply for scholarships. Now that break is starting, I am hoping they will find/make the time to apply for at least a few. I have compiled a very short list of some with December and January deadlines. Check them out and use a little of your holiday break free time to APPLY!

Niche Monthly $1000 Scholarship

Due: December 20, 2020

Open to high school, college, and graduate students, and those planning to enroll within 12 months. Simply fill out a short form.

https://www.niche.com/colleges/scholarship/december-scholarship/

Peck Law Group Elder Abuse and Neglect Scholarship

Amount: $700

Due: December 29, 2020

Scholarship is open to students who have been accepted to or are enrolled in college. Create an article on elder abuse and neglect of at least 1000 words (the more the better).

https://www.premierlegal.org/elder-abuse-neglect-infographic-scholarship/

Spotless Cleaning Chicago Scholarship

Amount: $1,000

Due: December 30, 2020

If you are a dynamic, passionate, hard-working student in high school, college, university, or trade school, create a 2-4 minute video explaining why you think education is the key to a brighter future, and how you can shape society.

https://www.spotlesscleaningchicago.com/scholarship/

Shawn Sukumar 2020 Extracurricular Impact scholarship

Amount: $1000

Due: December 31, 2020

Open to US high school seniors and students currently enrolled in college.

An amount of $1,000 will be awarded to one student who best conveys in a 750-1,000 word essay how extracurricular activities have had an impact on their life and academic success. This can be an activity you are currently participating in or have previously been involved with. Whether it’s music lessons, art classes, sports teams, debate, or volunteering that garners your interest, what lessons have these extracurricular activities taught you that you have applied to your classes in school? What kind of positive impact have they had on your life as a whole?

https://washingtondccriminallawyer.net/2020-scholarship/

Fire Free Speech Essay Contest

Amount: Up to $10,000

Due: December 31, 2020

Open to US high school juniors and seniors. In a persuasive letter or essay, convince your peers that free speech is a better idea than censorship. Your letter or essay must be between 700-900 words. We encourage you to draw from current events, historical examples, our free speech comic, other resources on FIRE’s website, and/or your own personal experiences.

https://www.thefire.org/resources/high-school-network/essay-contest/

Fundera College Scholarship

Amount: $2,000

Due: January 1 and June 1 each year

Scholarship is open to incoming and current college students in the United States. Applicant must be a young entrepreneur. Student must submit a video on a topic related to technology and small businesses. https://www.fundera.com/resources/fundera-scholarship

The Foot Locker Scholar Athletes Scholarship

Foot Locker will celebrate 20 athletes for whom sports has helped them become leaders in their school and community by awarding them up to $25,000.

Due: January 8, 2021

For HS Seniors, class of 2021

https://app.goingmerry.com/scholarships/foot-locker-scholar-athletes-2021/7996

Profile in Courage Essay Contest

Amount: Several scholarships up to $10,000

Due: January 15, 2021

Contest is open to United States high school students in grades nine through twelve. Describe and analyze an act of political courage by a US elected official who served during or after 1917. Essay 700-1000 words.

https://www.jfklibrary.org/Education/Profile-in-Courage-Essay-Contest.aspx

LiveMas Scholarship

Various scholarship amounts totaling $7 million

Due: January 20, 2021

Open to students 16 and above who plan on or already are attending college.

The Live Más Scholarship is not based on your grades or how well you play sports. No essays, no test scores, no right or wrong answers. Submit a two minute video that tells us the story of your life’s passion. This is not about how well you can make a film – we just want you to tell us about your passion and how you will use it to make a difference.

https://www.tacobellfoundation.org/live-mas-scholarship/

I have a Dream Scholarship

Amount: $1,500

Due: January 31, 2020

Ages 14 and up may apply

"We want to know... what do you dream about? Whether it's some bizarre dream you had last week, or your hopes for the future, share your dreams with us for a chance to win $1,500 for college." (250 words or less)

https://www.unigo.com/scholarships/our-scholarships/i-have-a-dream-scholarship

My additional tips for your scholarship search: https://www.acmcollegeconsulting.com/blog/2019/1/2/the-spring-scholarship-search

TIME FOR MORE?

For more scholarships, I recommend checking out these pages which require you to set up a FREE account. Remember you should never have to pay to apply and be careful with what information you share and how that information will be used.

https://www.fastweb.com/

SWFL STUDENTS

Don’t forget to apply for the Southwest Florida Community Foundation Scholarship funds. The application is due by January 11. It is a wonderful opportunity to receive funding specifically for students from your region and they have a lot to give!

https://floridacommunity.com/scholarships/

Financial Aid Application Time

As college application season is fully underway, it is important to learn about the primary financial aid applications and types of aid your student could receive. The two most common applications used by colleges across the US are the FAFSA and CSS PROFILE, and they need to be filed prior to each year the student plans on attending college. Both applications open on October 1, so prepare to get them started now.

As college application season is fully underway, it is important to learn about the primary financial aid applications and types of aid your student could receive. The two most common applications used by colleges across the US are the FAFSA and CSS PROFILE, and they need to be filed prior to each year the student plans on attending college. Both applications open on October 1, so prepare to get them started now.

The FAFSA (Free Application for Federal Student Aid) is the standard form used by all schools to determine the amount of federal aid a student will receive. The FAFSA calculates the EFC (Expected Family Contribution), what the government considers a reasonable amount the family should be able to contribute to the student's educational costs whether or not a parent wants to contribute to their child's education. For the 2021-22 school year, you will file using prior-prior (2019) tax information. To make things simpler, use the integrated IRS Data Retrieval Tool which will pull your tax information to automatically fill out a lot of the form for you.

The CSS Profile (College Scholarship Search Profile) is used by around 150 colleges, primarily private, to determine eligibility for non-federal funding aka institutional aid. It is filed through the College Board online. This application uses prior and prior-prior tax year information. So if you are applying for 2021-22, you will use 2019 and 2020 information. Not sure if your college uses the CSS Profile? Check out the list of schools here and check directly with the colleges.

It is important to know that the earlier you file the CSS Profile and FAFSA, the more funding you may receive as some grants are given on a first come, first serve basis. Also, each state and college has their own deadline for when you need to file, and these often fall around the time the college applications are due. Start early and aim to have your financial aid applications complete two weeks before your student's first admission application deadline. You can actually submit them before you finish your college applications. If you are about to make a large purchase or make any significant payments, you should make them before updating your bank balance information. Other than that, do not delay completing your financial aid applications.

The CSS Profile digs a little deeper into your family's financials than the FAFSA. Some key differences are that it includes home equity of primary dwelling, family farms, value of small businesses, and for some schools, the non-custodial and/or stepparent income and cash value of life insurance policies. Before you begin, it is helpful to gather the materials you will need to complete the applications:

An FSA ID to sign the FAFSA electronically (you can apply for this special username and password online via https://fsaid.ed.gov/npas/index.htm and the student and the custodial parent will need separate IDs. The student needs to get their ID first.)

A College Board account to complete a CSS Profile – the student and custodial parent will share the login, if a non-custodial parent needs to fill out a separate application, you will receive notification after adding your schools to the list

Social Security Numbers

Federal Income Tax Returns, W-2s, and other records of income earned

Bank statements and records of investments

Mortgage statement

Records of untaxed income such as child support and interest income

List of schools student is applying to

Ensure that the information you have entered is accurate and complete to prevent any delays in the processing of your application. Make sure you have added any schools to which you are applying to the FAFSA and CSS Profile applications so that they receive the information. Filing the FAFSA is free, but the CSS Profile costs $25 for the application and first school and $16 for any additional. If you need to add colleges to either application later, you can always log back in and do that.

If your family's financial situation has changed for the current year and the tax information you must use for the application does not properly reflect it, it is important that you contact each of the colleges and inform them of your current situation. Examples may include hurricane loss, death in the family, loss of job or illness. For any questions regarding each college's financial aid policy and types of aid awarded, take a look at their website and feel free to reach out to their office.

Thinking of skipping the financial aid applications? While the FAFSA is primarily used to determine federal funding, some schools also use it to determine the distribution of their own institutional aid if they do not require the CSS Profile. A few schools also use the forms to help determine Merit Aid. Even if you think you will not qualify for additional aid, if you want to get any of the federal loans you still need to complete the FAFSA. And if you skip applying for aid one year and need institutional aid from the school in the future, you may have trouble getting it.

ADDITIONAL INFORMATION

Not sure of which parent should complete the FAFSA? https://studentaid.gov/resources/fafsa-parent-text

FAFSA Tips https://studentaid.gov/apply-for-aid/fafsa/filling-out

CSS Profile Tips https://www.nerdwallet.com/article/loans/student-loans/css-profile

Financial Aid Applications

As college application season is fully underway, it is important to learn about the primary financial aid applications and types of aid your student could receive. The two most common applications used by colleges across the US are the FAFSA and CSS PROFILE, and they need to be filed prior to each year the student plans on attending college.

As college application season is fully underway, it is important to learn about the primary financial aid applications and types of aid your student could receive. The two most common applications used by colleges across the US are the FAFSA and CSS PROFILE, and they need to be filed prior to each year the student plans on attending college.

The FAFSA (Free Application for Federal Student Aid) is the standard form used by all schools to determine the amount of federal aid a student will receive. The application opens online on October 1 each year and closes the following June 30. The FAFSA calculates the EFC (Expected Family Contribution), what the government considers a reasonable amount the family should be able to contribute to the student's educational costs whether or not a parent wants to contribute to their child's education. For the 2020-21 school year, you will file using prior-prior (2018) tax information.

The CSS Profile (College Scholarship Search Profile) is used by many colleges, primarily private, to determine eligibility for non-federal funding aka institutional aid. It is filed through the College Board online. This application also opens October 1 and will use prior and prior-prior tax year information. So if you are applying for 2020-21, you will use 2018 and 2019 information.

It is important to know that the earlier you file the CSS Profile and FAFSA, the more funding you may receive as some grants are given on a first come, first serve basis. Also, each state and college has their own deadline for when you need to file, and these often fall around the time the college applications are due. Start early and aim to have your financial aid applications complete two weeks before your student's first admission application deadline. There is no harm in submitting the forms before the actual admission applications are completed. If you are about to make a large purchase or make any significant payments, you should make them before updating your bank balance information. Other than that, do not delay completing your financial aid applications.

While the FAFSA is primarily used to determine federal funding, some schools also use it to determine the distribution of their own institutional aid if they do not require the CSS Profile. Therefore, it is often recommended that all students fill out the FAFSA and do it early, whether or not they think they will be eligible for federal aid. Visit the colleges' financial aid websites to find out whether or not you need to file the CSS Profile in addition to the FAFSA.

The CSS Profile digs a little deeper into your family's financials than the FAFSA. Some key differences are that it includes home equity of primary dwelling, family farms, value of small businesses, and for some schools, the non-custodial and/or stepparent income and cash value of life insurance policies. Before you begin, it is helpful to gather the materials you will need to complete the applications:

An FSA ID to sign the FAFSA electronically (you can apply for this special username and password online via fsaid.ed.gov or other U.S. Department of Education websites and the student and the custodial parent will need separate IDs)

A College Board account to complete a CSS Profile – the student and custodial parent will share the login, if a non-custodial parent needs to fill out a separate application, you will receive notification after adding your schools to the list

Social Security Numbers

Federal Income Tax Returns, W-2s, and other records of income earned (Note: You may be able to use the FAFSA's IRS Data Retrieval Tool which transfers the data directly from your completed tax returns to your application)

Bank statements and records of investments

Mortgage statement

Records of untaxed income such as child support or interest income

List of schools student is applying to

Ensure that the information you have entered is accurate and complete to prevent any delays in the processing of your application. Make sure you have added any schools to which you are applying to the FAFSA and CSS Profile applications so that they receive the information. Filing the FAFSA is free, but the CSS Profile costs $25 for the application and first school and $16 for any additional. If you need to add colleges to either application later, you can always log back in and do that.

If your family's financial situation has changed for the current year and the tax information you must use for the application does not properly reflect it, it is important that you contact each of the colleges and inform them of your current situation. Examples may include hurricane loss, death in the family, loss of job or illness. For any questions regarding each college's financial aid policy and types of aid awarded, take a look at their website and feel free to reach out to their office.

Budgeting in College

While keeping track of finances may not be of concern to some students, it is a valuable skill to learn for all. Students should take the time to sit with their family and discuss budgeting before arriving on campus for freshman year. Many unexpected expenses could arise and it is important for students and their families to establish a plan for how decisions about these expenses will be made and how they may be paid for.

While keeping track of finances may not be of concern to some students, it is a valuable skill to learn for all. Students should take the time to sit with their family and discuss budgeting before arriving on campus for freshman year. Many unexpected expenses could arise and it is important for students and their families to establish a plan for how decisions about these expenses will be made and how they may be paid for.

After the first major decision of how the direct expenses (expenses paid directly to the school) of tuition and fees and room and board will be paid for, families have to take into consideration the indirect expenses which will most likely be incurred. These usually include transportation, books and supplies, and personal expenses such as health insurance. Creating a list of these expenses and calculating what is expected to be needed monthly will help families understand what funds are necessary before the bills come in. A plan should be in place for paying for these expenses before the student sets off for college.

In addition to the expected expenses, it is a good idea to budget for the unexpected such as additional trips or activities the student may want to do and other discretionary spending for the student. Where will these funds come from? Make a plan!

Many students already have their own checking account from saving and working while in high school, but if they do not, it is time to set one up together. Many banks offer a free checking account, but it is worth considering banks local to the college first in case an issue arises. Parents can easily send money to the account as needed and get access to the account summary (if student agrees of course).

There are some very helpful programs to assist with keeping track of budget and spending and it is great practice for life in the 'real world'. Mint is a free program which allows you to set a budget for different categories, keep track of all expenses and bills, and make sure you make your payments on time. At any time you can log in to see where you stand for the month and get a good look at how well you are staying on budget. They also have a mobile app which is perfect for today's students who never go anywhere without their phone.

Should students get a credit card? College is a great time for students to get their first credit card not only to have in case of emergency, but also to begin building their own credit history. They can also begin to acquire points for spending. As long as the student understands what the card should be used for, payments are made on time and you choose one with no fees, it is a great thing to have. Take a look at NerdWallet's May list of Best College Student Credit Cards to get an idea of the associated details to consider.

Keep in mind as you are budgeting for future years that you need to fill out the FAFSA each year to continue to receive financial aid and you can continuously apply for outside scholarships throughout the student's college years. If you have any major changes in your financial situation which would increase your need, be sure to communicate that with the financial aid office as soon as possible.

Make a plan, talk about it, and continue to communicate the importance of budgeting and discussing expenses after the student is on campus. It is a lifelong skill we all need and an important part of your student's journey to adulthood.

All About Bright Futures

What is Bright Futures? How do you become eligible for the scholarship? If you are planning on or even considering attending college in Florida, you need to know this information and the earlier, the better.

What is Bright Futures? How do you become eligible for the scholarship? If you are planning on or even considering attending college in Florida, you need to know this information and the earlier, the better. While there are 4 types of scholarships which are part of Florida Bright Futures Program, this information is focused on the 2 primary scholarships for students who plan on pursuing an undergraduate degree or certification at a college or university in Florida – the Florida Academic Scholars (FAS) and the Florida Medallion Scholars (FMS).

To be eligible for Bright Futures, students must:

Be a Florida resident and US citizen or eligible non citizen

Graduate from a Florida public high school or a registered Department of Education Private institution, earn a GED or complete an eligible Home Education program

Meet high school college prep coursework requirements

Be accepted to and enrolled at a Public or eligible private post-secondary institution in Florida

Not have been convicted of or plead no contest to felony charges

Meet official standardized test score and GPA requirements

Complete 100 hours of volunteer service and/or paid work

Have official transcripts sent from high school

Complete the Florida Financial Aid Application (FFAA) by Aug. 31 after senior year

Image from Bright Futures Handbook

The FAS scholarship is the highest level available to students and covers 100% of tuition and applicable fees at Florida public institutions. If a student chooses to attend an eligible private institution, they are given a comparable amount which could add up to approx. $6000.

The FMS scholarship is the second tier and covers 75% of tuition and applicable fees or 100% of an associates degree. It also covers a comparable amount at eligible private institutions.

To apply for Bright Futures, students must first complete the Florida Financial Aid Application (FFAA). This application typically opens on October 1 and must be completed by August 31 post graduation. After applying for the FFAA, the student will gain access to complete the Bright Futures application.

Students can send their test scores by simply requesting an official test score to be sent to any of the 12 Florida sate universities, state colleges or public high schools. Students have until August 31 post graduation to meet the testing requirements, which means completing testing by June 30. Scores can be superscored and students can take it as many times as needed to get the minimum required scores. Students can bypass the test score requirements if they complete an AICE or IB Diploma.

Service and work hours must be completed by high school graduation. To verify what activities meet the service hour requirements, students should speak to their high school counselors. Whatever the activity may be, the student must get the signed verification from the appropriate supervisor. Activities which typically count towards the service hours are volunteering for nonprofits, working on local political campaigns, or interning at local businesses. As of June 2022, paid work now counts towards the 100 hour requirement.

Students can complete their application any time after December, when they are able to officially enroll at one of the eligible post-secondary institutions. The funds will be distributed directly to the college. Students should ensure they keep their account updated with the institution they are attending as well as their service hours. They should also make sure their counselor sends their official transcripts.

Both levels of Bright Futures can be used for summer semester and depending on the college's programs, may be able to be used for study abroad. A common misconception is that the Bright Futures is a 'full ride'. However, it covers solely the tuition and some fees. unless a family has a 529. Families should not neglect to seek additional funding such as scholarships and other institutional and federal financial aid. Parents should follow all deadlines to file the FAFSA and CSS PROFILE where required in order to be eligible for other aid.

When families have a 529 Plan, the schools apply those funds first and then the Bright Futures. In this case, Bright Futures funds can be used for expenses other than standard tuition and fees. If there are funds left over, the school will usually give them back to the student to use for additional expenses.

Consider the requirements early as you go through high school and begin to complete the service hours, meet college prep course requirements, and prepare for standardized tests to ensure you do not miss out on these extra funds! Schedule a free consultation with us to discuss Bright Futures and your college search and applications.

The Spring Scholarship Search

Searching for Scholarships can definitely begin earlier than senior year, but now is a perfect time for seniors to use their free time for searching and applying for scholarships. Many students ask me where to search and how to get the most money. Unfortunately, there is no single, simple answer.

Now that college applications are complete, it is a perfect time for HS seniors to use some of their free time for searching and applying for scholarships. There are also many scholarships for younger students, so non-seniors could benefit from dedicating some time to this too. Many students ask me where to search and how to get the most money. Unfortunately, there is no single, simple answer. There are scholarships everywhere just waiting to be found! Here are some tips for your search for the $$$.

Of course getting scholarships from your potential college is the first stop. You should have filled out the FAFSA and/or CSS Profile by now if you have applied to college. If you have not completed those financial aid applications, do it ASAP! Colleges use these forms for determining financial aid awards and much of it is awarded on a first come-first serve basis. You will see what your scholarship and aid awards are on your financial aid award letter which you will receive from your potential colleges before May 1. If you are a junior considering your options, remember to take a look at the academic scholarships and financial aid colleges offer before applying. Some of the scholarships require a separate application and may even have an earlier deadline than the regular college applications. You do not want to miss out on those.

There are so many scholarship search websites it is often overwhelming. Select just 2-3 and consistently check them for updates. Some of the to best pages are:

Fastweb - After signing up and completing a profile (yes, many pages require this), you will be able to search and get matched with their database of around 1.5 million scholarships. You are able to keep your scholarships organized by those you are not interested in, those you would like to apply for and those you have already applied for.

Scholarships.com - Scholarships.com updates their database of more than 3.5 million scholarships to be sure to only include legitimate, current scholarships. Similar to fastweb, you sign up and complete a profile to get matched with potential scholarships.

Consider the local opportunities before jumping into the small nationwide scholarships. Great scholarship resources can be local community organizations, student and parent employers, banks, churches, and companies. Most states also have their own form of scholarship or grant for residents, for example the PHEAA grant for PA residents, Florida Bright Futures, and Hope Scholarship in Georgia. Click on your state on this handy map and find out what is available. These can be very valuable resources and should not be overlooked. Some of these statewide programs such as Bright Futures require a certain GPA, test scores, and community service hours which need to be taken into consideration earlier than senior year.

Although it may seem daunting to have to write yet another essay for an application or fill out another form, it may end up being well worth your time. As someone recently pointed out to me, ‘if you spend 2 hours on an application and end up getting $1000, that is $500 an hour. Where else can you get that?’ Take some time and submit quality applications.

A final note of caution to those of you on the hunt for funds - beware of the websites which require payment for access to scholarship lists or people who guarantee they will get you scholarships. As you know by now, almost nothing in the college application world is a guarantee and you are capable of finding the scholarships on free websites.

Additional Resources

National Association of Student Financial Aid Administrators parent and student resources: https://www.nasfaa.org/students_parents_counselors

Read more about scholarship scams here: https://www.consumer.ftc.gov/articles/0082-scholarship-and-financial-aid-scams

SWFL Scholarships